Are you looking at ways to prepare your business for the future? At EC Credit Control we tend to take a long-term view of things.

By doing the same with your business and positioning it for the future, we know that even in today’s market there is plenty of room to thrive.

In this blog, we explore some ways in which you plan ahead for future success.

One of the key changes in people’s behaviour this year was the marked increase in doing things online. Whether it was to socialise, make purchases or pass the time, people have been flocking to the internet in record numbers. Many have overcome their fears about online shopping or video chats and have started to include these in their every day.

If you haven’t already created a digital presence, now is the time to do so. And if you do have a digital presence but it needs some love, now is the time to give it.

Here are some tips to build your online presence:

Your business is only as strong as your staff. In today’s world, your staff is just as pressed for time as your customers. Adapt to modern ways of engaging them and help build their collective strength.

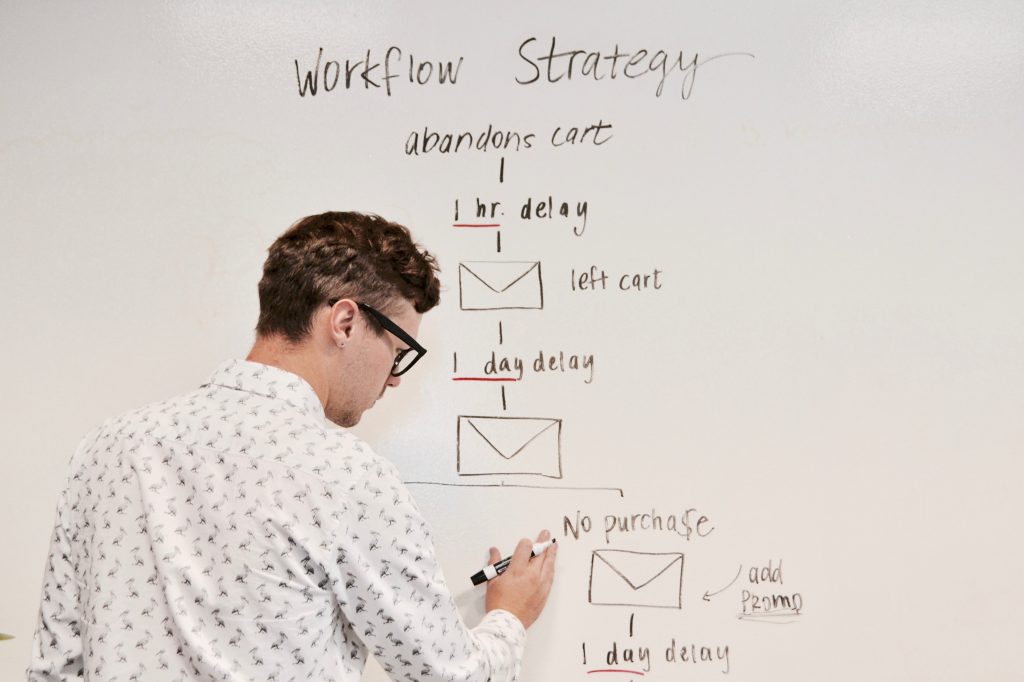

It’s time to look at your processes from a critical viewpoint. Could someone step in today and be able to keep your business running without you? Without clear processes, how much is your business really worth?

Steps you can take include;

It’s important to be prepared for the unexpected. Whether it happens or not, and to what degree, you should put resources into surviving a downturn.

We believe business success comes from crystallising your thoughts into smart moves. Finally, take some time to reflect on these final ideas:

At EC Credit Control we’ve been helping businesses of all sizes succeed. Rather than looking at one end of the spectrum, we are focused on how your debt management process works as a whole.

We believe that in doing this we’re able to help you protect and build up your cash flow in a sustainable way, no matter what is going on in the world.

To sum up:

(please include your contact details)

Melbourne, Sydney, Perth, Brisbane, Adelaide & Tasmania

EC Credit Control (Aust) Pty Ltd