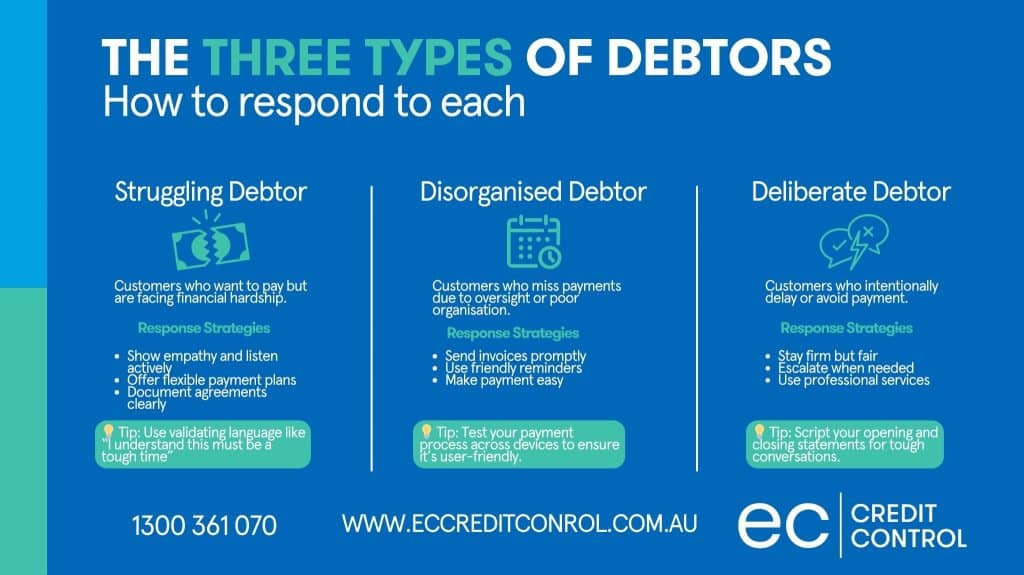

Recovering debt while maintaining customer relationships is a delicate balance. At EC Credit Control, we know that understanding your debtor’s mindset is key to successful recovery. Not all debtors are the same, and tailoring your approach can make all the difference. Here are the three main types of debtors—and how to respond to each one effectively. Plus, we have a free downloadable infographic you can use to help you manage your debtor conversations.

These customers want to pay but are facing financial hardship. They may be dealing with cash flow issues, unexpected expenses, or economic pressures. Typically, they have a history of timely payments and good communication.

How to Respond:

💡 Tip: Use validating language like “I understand this must be a tough time” to build trust and cooperation.

These customers miss payments due to oversight or poor organisation. They’re not avoiding payment—they just need reminders and better systems.

How to Respond:

💡 Tip: Test your payment process across devices to ensure it’s user-friendly.

These are the most challenging debtors. They may be intentionally delaying payment, disputing charges without basis, or ignoring communication.

How to Respond:

💡 Tip: Script your opening and closing statements for tough conversations to stay focused and calm.

Recognising which type of debtor you’re dealing with helps you:

At EC Credit Control, we believe debt recovery doesn’t have to be confrontational. With the right mix of empathy, clarity, and professionalism, you can recover what’s owed while keeping your business relationships intact.

✅ Download the infographic and use it as a guide in your conversations with debtors.

Let us take the stress out of debt recovery. Our online debt collection process is simple, and our team is here to support you every step of the way.

👉 Load your debt today—it only takes a few minutes.

Our customer service team are ready to help, simply call us on 1300 361 070 or fill in the form below and we will be in touch within the next business day.

EXCELLENTTrustindex verifies that the original source of the review is Google. We've always had a great experience dealing with EC Credit Control. They're quick to respond and I get to talk to real people when I need to. I feel much more confidence with their backing.Posted onTrustindex verifies that the original source of the review is Google. I have found Philip and the team at EC Credit Control to be really understanding and easy to work with. They actually listen to what you need, give helpful advice, and come up with solutions that fit your situation. What I like most is that they don’t just get the job done — they make sure it’s implemented in the smartest way for your business. I’d definitely recommend Philip and EC Credit Control to anyone I know.Posted onTrustindex verifies that the original source of the review is Google. Philip explained everything. Any questions you need to know Philip will answer themPosted onTrustindex verifies that the original source of the review is Google. I've had the pleasure of working with Monika and her team since 2020, and over the past five years, they've consistently demonstrated professionalism and integrity. Monica is incredibly easy to work with and always so thoughtful. Their support in resolving unpaid invoices and disputes has been invaluable to our small business, and we really appreciate their dedication and efficiency. Highly recommended!Posted onTrustindex verifies that the original source of the review is Google. I was recommended EC Credit Control by another Company when we had trouble trying to get an invoice paid. After speaking with Michael, we realised that we needed to implement some serious Terms of Trade documents among other things into our paperwork and he explained everything perfectly. There were so many areas of the business that weren't protected - ranging from other companies who may decide not to pay or go bankrupt, or even subcontractors who injure themselves and try to sue us. I am confident that if anything happens down the track, we will be protected and have the backing of EC Credit control behind us.Posted onTrustindex verifies that the original source of the review is Google. I could not be thankful enough for the support of Philip and Nadine. They took the time to understand my business requirements, design tailored documents and walk me through each documents. Warmly recommended and an absolute must for any business.Posted onTrustindex verifies that the original source of the review is Google. Easy to deal with and were able to achieve some unexpectedly good outcomes.Posted onTrustindex verifies that the original source of the review is Google. Great team to work with.Posted onTrustindex verifies that the original source of the review is Google. Friendly, professional team and always able to help and assist when needed.Verified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more